If you’re involved in the manufacturing sector, specifically in electronics or assembly line operations, you’re likely familiar with the significance of pick-and-place machines. These automated devices play a vital role in streamlining production and increasing efficiency. However, when it comes to importing pick-and-place machines, understanding the applicable tariffs and regulations can be daunting. In this article, we will delve into the complexities of import tariffs associated with these machines, offering insights to help you navigate this crucial area.

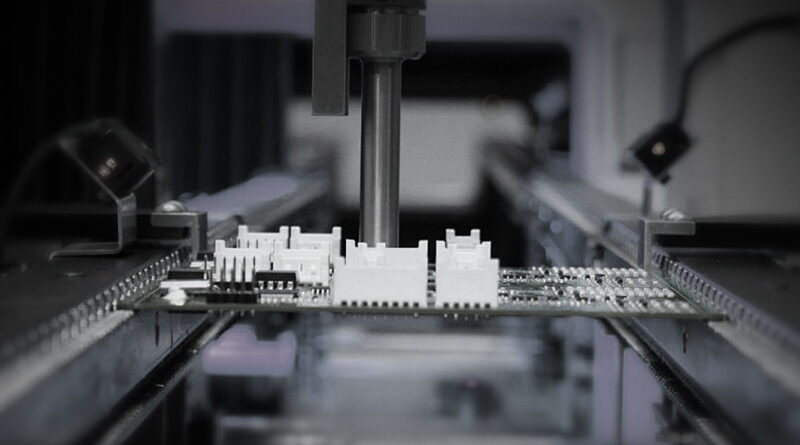

What Are Pick-and-Place Machines?

Pick-and-place machines are robotic devices that pick up components from a supply and place them onto a circuit board. They are essential in the electronics manufacturing process, where precision and speed are critical. These machines reduce human error, increase production rates, and lower long-term costs, making them an attractive investment for manufacturers.

The Role of Tariffs in International Trade

Trade tariffs are taxes imposed on imported and exported goods. They serve various purposes, including protecting domestic industries, generating government revenue, and influencing international trade relations. For manufacturers looking to import equipment such as pick-and-place machines, understanding these tariffs is crucial to budgeting and pricing strategies.

How Tariffs Affect the Import of Pick-and-Place Machines

Import tariffs can significantly affect the overall cost of acquiring pick-and-place machines from overseas. These machines can have substantial upfront costs, and additional tariffs can inflate these expenses, making it essential to factor this into your investment decisions. Tariffs often vary based on the machine’s country of origin, specifications, and value, leading to different potential costs.

Types of Tariffs Applicable to Pick-and-Place Machines

When importing pick-and-place machines, several types of tariffs may apply:

- Ad Valorem Tariffs: These are calculated as a percentage of the value of the goods. For instance, if a pick-and-place machine is valued at $100,000 and the tariff rate is 5%, the tariff would amount to $5,000.

- Specific Tariffs: These are fixed fees based on specific criteria. For example, a $10,000 tariff might apply regardless of the machine’s value.

- Compound Tariffs: These combine both ad valorem and specific tariffs, meaning the import cost could be based on the value of the goods plus a fixed fee.

Factors Influencing Tariff Rates

The tariff rate applied to pick-and-place machines can depend on various factors, including:

- Country of Origin: Different countries have different trade agreements and tariff rates. For example, machines imported from countries under a free trade agreement might have lower tariffs.

- Machine Specifications: Some specialized machines might qualify for lower tariffs due to their unique capabilities or applications.

- Trade Policies: Government policies and international relations can influence tariffs. Changes in administration or policy can lead to fluctuating rates.

Navigating Import Tariffs: Tips for Manufacturers

To successfully navigate the complexities of import tariffs, consider the following tips:

- Research Current Tariffs: It’s essential to stay updated on the current tariff rates for importing machinery like pick-and-place machines. Resources such as the Harmonized System (HS) codes can help you determine applicable tariffs.

- Consult with Experts: Working with a customs broker or trade consultant can provide you with valuable insights and help streamline the import process.

- Consider Total Landed Cost: Be sure to account for all costs involved in the import process, including transportation, tariffs, and handling fees. This gives you a clearer picture of the financial impact.

- Explore Alternative Markets: If tariffs are prohibitive, consider sourcing machinery from countries with lower tariffs or favorable trade agreements.

The Impact of Tariffs on Pricing Strategy

Understanding how tariffs affect costs is crucial for developing an appropriate pricing strategy. If your business imports pick-and-place machines with high tariffs, this cost may need to be passed on to customers. This could potentially affect your competitive edge in the market, so it is vital to balance profitability with competitiveness. Similarly, constantly monitoring change in tariffs will inform any necessary adjustments to your pricing strategy.

Case Study: The Implications of Tariffs on Manufacturing Operations

To illustrate the impact of tariffs, let’s consider a hypothetical scenario: A manufacturing firm in the United States imports pick-and-place machines from China. Initially, the firm benefited from a 2% tariff rate due to favorable trade relations. However, due to political changes, the tariff rate increased to 25%. This increase significantly inflated the import costs and forced the company to reassess its pricing strategy and operational viability. They had to consider whether the increased costs would necessitate passing on increases to customers or possibly seeking alternative suppliers to mitigate costs.

Future Trends in Tariffs and Trade Policy

As globalization continues to shape international trade, tariffs will likely evolve. Emerging trade agreements or regulatory changes can lead to shifts in tariff rates. For manufacturers, staying abreast of these trends is essential for strategic planning. As tariffs increase or decrease, businesses must be adaptable, embracing new technologies or sourcing strategies to remain competitive.

In conclusion, navigating the complexities of import tariffs on pick-and-place machines is crucial for manufacturers looking to optimize their production processes. Understanding the types of tariffs, influences on rates, and practical strategies for managing these costs can position your business for success in a competitive market. Start prioritizing your research today to secure the best possible outcomes in your import operations.