The pick-and-place machine is a cornerstone technology in modern manufacturing, integral to the assembly line process, especially in electronics production. However, for businesses looking to import these machines, understanding the associated import tariffs is crucial for decision-making and budget planning. In this article, we’ll delve into the complexities of import tariffs specifically related to pick-and-place machines, discussing their implications on costs and how businesses can effectively navigate this landscape.

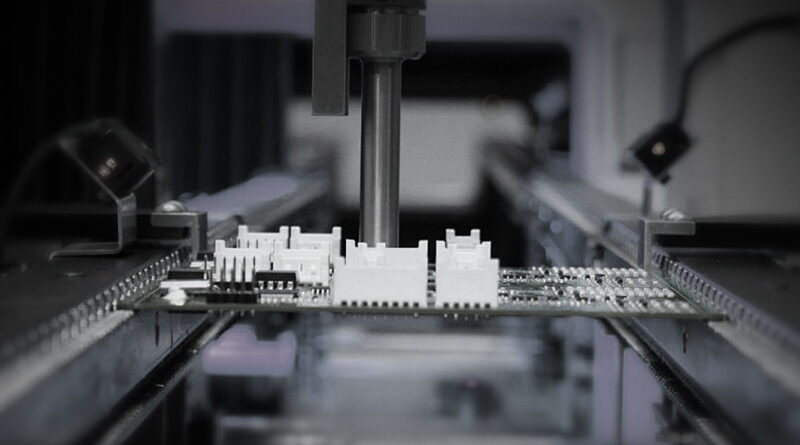

What are Pick-and-Place Machines?

Pick-and-place machines automate the process of moving items within assembly lines, providing speed and accuracy that human labor often cannot match. These machines are primarily used in the electronics industry for placing components onto printed circuit boards (PCBs). This automation boosts productivity significantly while minimizing human error.

Understanding Import Tariffs

Import tariffs are taxes imposed by governments on imported goods. They serve multiple purposes: protecting local industries, increasing government revenue, and regulating international trade. For companies importing pick-and-place machines, tariffs can impact overall costs significantly. Understanding how these tariffs are calculated and the factors influencing them is critical.

Tariff Classification and HS Codes

To determine import tariffs, it’s vital to understand the Harmonized System (HS) codes. HS codes are internationally standardized numbers that classify traded products. Pick-and-place machines fall under specific HS codes, which can vary based on their features and functionalities. Choosing the correct HS code is essential, as even minor discrepancies can lead to the wrong tariff classification and unexpected costs.

Factors Influencing Import Tariffs

Various factors can influence the import tariffs on pick-and-place machines, including:

- Country of Origin: Tariffs can vary depending on the manufacturing country of the machine, as trade agreements may provide lower tariffs for certain nations.

- Machine Features: The specifications, such as automation levels and performance capabilities, can affect the final tariff classification.

- Trade Agreements: Bilateral or multilateral trade agreements may impact the tariff rates applicable to imports from specific countries.

- Customs Valuation: The overall cost of the machine, including duties and freight, will determine the valuation upon which tariffs are calculated.

Strategies to Navigate Import Tariffs

For businesses looking to mitigate the financial impact of import tariffs, several strategies can be employed:

1. Conduct Thorough Research

Before importing, engaging in comprehensive research about applicable tariffs and regulations is vital. This includes understanding the specific HS codes for pick-and-place machines and consulting with trade compliance experts.

2. Work with Experienced Customs Brokers

Customs brokers are invaluable resources when navigating complex tariff regulations. They can assist in proper classification, ensuring compliance with local laws and avoiding costly penalties.

3. Leverage Trade Agreements

Exploring available trade agreements can yield significant savings. Importers should investigate whether their target countries participate in any trade agreements that could lower import tariffs.

The Impact of Tariffs on Pricing Strategy

The tariffs levied on pick-and-place machines can have a substantial impact on overall pricing strategy. Companies must factor these costs into their pricing models, considering whether to absorb them, pass them onto customers, or find efficiencies in production to offset the costs.

Case Studies: Tariff Impacts on Businesses

To illustrate the effects of import tariffs, consider the following case studies of companies that faced varying tariffs for their pick-and-place machines:

Case Study 1: A Mid-Sized Electronics Manufacturer

This manufacturer faced a 10% tariff on machinery from a non-FDA country. They implemented a strategy to work closely with their customs broker to ensure accurate valuation, which ultimately saved them thousands of dollars.

Case Study 2: An International Automobile Firm

A larger corporation leveraging multiple trade agreements was able to reduce tariffs to 2% by sourcing pick-and-place machines from qualified countries, significantly lowering their overall import costs.

Looking Ahead: Future Trends in Tariffs

As geopolitical climates shift, so do tariff regulations. The rise of protectionist policies in several regions can lead to increased tariffs. However, the push for globalization and the establishment of new trade agreements can counterbalance this trend, creating opportunities for businesses.

Conclusion

While understanding import tariffs on pick-and-place machines may seem daunting, businesses can thrive by remaining informed and proactive. By leveraging trade agreements, working with customs experts, and employing strategic import practices, they can effectively manage costs and remain competitive in the ever-evolving manufacturing landscape.