In the fast-evolving landscape of manufacturing and assembly, pick-and-place machines have emerged as an essential component for ensuring efficiency and precision. However, navigating the labyrinth of import tariffs can be a daunting task for businesses looking to acquire this pivotal equipment. In this blog post, we delve into the world of import tariffs specifically for pick-and-place machines, exploring the factors that influence these tariffs, providing insights into their calculation, and offering tips on how to manage these costs effectively.

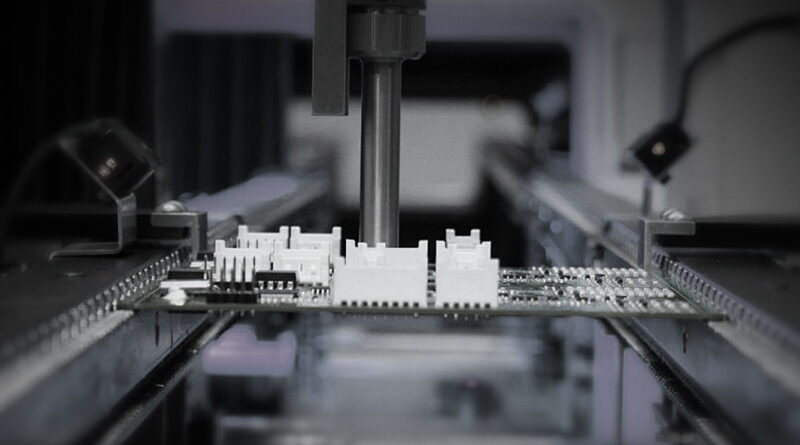

What Are Pick-and-Place Machines?

Pick-and-place machines are automated devices used in manufacturing to pick up components from one location and place them onto a circuit board or assembly line. With applications ranging from electronics to pharmaceuticals, these machines are vital in enhancing productivity and minimizing errors associated with manual assembly.

The Role of Import Tariffs

Import tariffs are taxes imposed by governments on imported goods. These tariffs serve multiple purposes: protecting domestic industries, generating revenue, and sometimes retaliating against unfair trade practices. For businesses importing pick-and-place machines, understanding how these tariffs work is crucial for accurate budgeting and financial planning.

Factors That Influence Import Tariffs

Several factors play a role in determining import tariffs for pick-and-place machines:

- Country of Origin: Tariffs can vary significantly based on the manufacturing location of the equipment. Some countries may have trade agreements that reduce or eliminate tariffs, while others might impose hefty duties.

- Machine Classification: The Harmonized System (HS) code is critical in determining tariffs. Each product is assigned an HS code, which indicates the category it falls into, and tariffs are typically calculated based on these classifications.

- Trade Policies: Domestic and international trade policies can influence tariffs. Changes in government policies, trade wars, or new agreements can alter the landscape significantly.

The Importance of Accurate Classification

Every import item must be classified correctly to ascertain the applicable tariffs accurately. Misclassification can lead to underpayment or overpayment of taxes, resulting in penalties or unexpected costs. Therefore, it’s vital for businesses to either have an in-house expert or work closely with customs brokers to ensure proper classification.

Calculating Import Tariffs

The calculation of import tariffs involves understanding the customs value of the goods, which includes the cost of the machine, shipping expenses, and insurance. The typical formula used to calculate the total duty payable is:

Total Duty = Customs Value x Tariff Rate

For example, if the customs value of a pick-and-place machine is $50,000 and the applicable tariff rate is 5%, the total import duty would be:

Total Duty = $50,000 x 0.05 = $2,500

Understanding Additional Fees and Taxes

In addition to import tariffs, businesses must be aware of other fees and taxes that may apply when importing equipment. These can include:

- Value Added Tax (VAT): Many countries impose VAT on imported goods, which can add a significant cost.

- Excise Taxes: Some nations have specific excise taxes for particular classes of machinery.

- Customs Handling Fees: Fees that customs agents charge for processing the import documentation and handling the goods.

Tips for Managing Import Tariff Costs

Successfully managing import tariffs falls within strategic planning and effective negotiation. Here are some tips for businesses looking to control costs:

- Negotiate with Suppliers: Engage suppliers in discussing potential cost sharing for tariffs or consider sourcing from countries with lower tariff implications.

- Consult Trade Experts: Engaging import/export consultants can provide valuable insights and help navigate complex tariff systems.

- Explore Trade Agreements: Familiarize yourself with trade agreements, which may offer reduced tariffs and other advantages.

- Join Industry Groups: Many industry groups advocate for fair trade practices and may offer resources and support for navigating tariffs.

Recent Trends and Changes in Tariffs

Staying updated about recent changes in tariffs is essential for businesses. Trade tensions between countries, global economic shifts, and policy changes can lead to rapid adjustments in import tariffs. For example, manufacturers trying to import pick-and-place machines from countries that are currently facing trade sanctions may experience higher tariffs or even restrictions.

Real-world Case Studies

Understanding the impact of tariffs through real-world examples can elucidate the complexities involved. For instance, a mid-sized electronics manufacturer based in the U.S. imported pick-and-place machines from China. Initially, tariffs were manageable until a trade war escalated, causing duties on machinery to rise from 3% to 25%. As a result, the manufacturer’s overall costs soared, leading them to explore alternative sourcing options in Europe, where tariffs were more favorable.

The Future of Import Tariffs

The landscape of global trade is ever-evolving, and import tariffs will continue to play a crucial role in shaping business decisions. As tariffs fluctuate, staying informed and adaptable is key for importers of pick-and-place machines and other manufacturing equipment.

The Role of Technology in Tariff Management

Advancements in technology, particularly software tailored to logistics and customs management, can enhance efficiency in tariff calculation and compliance. Many companies are now leveraging artificial intelligence (AI) and machine learning tools to predict tariff changes and optimize their import strategies accordingly.

Educating Your Team

Equipping your team with knowledge about import tariffs is equally critical. Investing in training sessions that cover international trade laws and the nuances of tariffs will empower your workforce to make informed decisions, thus streamlining operations.

In an era where every dollar counts, being well-versed in the intricacies of import tariffs can provide companies with a competitive edge. Understanding how to navigate this complex framework will not only save costs but also streamline the procurement process for essential machinery like pick-and-place machines.