In the rapidly evolving landscape of manufacturing and automation, pick-and-place machines have emerged as a vital component. These machines not only streamline production processes but also enhance accuracy and efficiency. However, importing such advanced machinery comes with its own set of challenges, particularly regarding tariffs. In this article, we will explore the ins and outs of import tariffs specifically related to pick-and-place machines, the factors influencing these tariffs, and what you need to know as a business owner or importer.

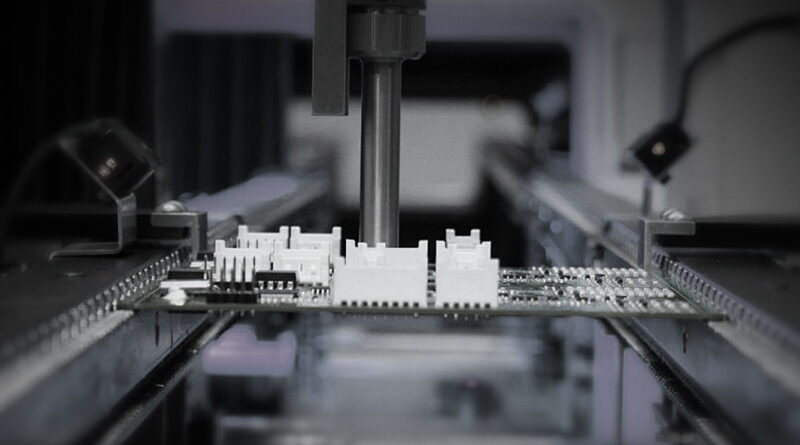

What are Pick-and-Place Machines?

Pick-and-place machines are robotic devices designed to automate the logistics of production. They are often used in industries such as electronics manufacturing, packaging, and assembly lines. These machines operate by picking items from one location and placing them in another, making them essential for high-volume production operations. Their accuracy and flexibility yield significant cost savings and efficiency improvements, driving many businesses to invest in importing these machines.

The Importance of Understanding Import Tariffs

Import tariffs are taxes imposed by governments on goods that are brought into a country. These tariffs are designed to protect domestic industries, regulate trade, and generate revenue. Understanding these tariffs is crucial for businesses looking to import pick-and-place machines for several reasons:

- Cost Analysis: Import tariffs can significantly impact the total cost of acquiring machinery. Businesses must factor these expenses into their budget to ensure profitability.

- Competitive Pricing: An understanding of tariffs will help businesses set competitive prices for their products and plan their market strategies accordingly.

- Compliance: Having knowledge about the tariffs ensures that businesses remain compliant with trade regulations, avoiding potential fines or legal issues.

How Are Tariffs Determined for Pick-and-Place Machines?

The determination of tariffs for importing pick-and-place machines involves several variables. The classification of the machinery based on the Harmonized System (HS) code is one of the primary factors. Each product category has a specific HS code, which directly influences the tariff rate applied. Here are some factors that influence tariff rates:

- Country of Origin: Tariff rates can vary depending on the country from which the machinery is imported. Free trade agreements or trade tensions can further influence rates.

- Type of Machinery: The specific design and function of the pick-and-place machine can also impact the tariff rate. For instance, machines with integrated advanced technology may have higher tariffs.

- Trade Policies: Governmental policies regarding imports and exports can change frequently, affecting tariff rates.

Current Tariff Rates for Pick-and-Place Machines

As of the latest updates, pick-and-place machines generally fall under several specific tariff categories. For many regions, particularly within the United States and the European Union, tariffs on such machinery can range from zero to 10 percent. However, these rates are subject to change based on international trade negotiations and policy adjustments. Therefore, it is recommended to consult with a trade expert or legal advisor to get the most current information:

- U.S. Import Tariffs: Typically, import duties for pick-and-place machines might hover around 2% to 6%, depending on specifications.

- EU Import Tariffs: In the European Union, rates vary, often averaging about 5% for machinery categorized similarly to pick-and-place systems.

Ways to Minimize Import Tariffs

Importing pick-and-place machines can be expensive, but there are various strategies businesses can employ to minimize the impact of tariffs:

1. Utilize Free Trade Agreements

Take advantage of free trade agreements that might lower or eliminate tariffs on certain machinery. Countries often negotiate tariffs to promote international trade.

2. Correct Classifications

Ensure that your machinery is correctly classified under the applicable HS code. Misclassification can lead to higher tariffs, while proper classification can result in significant savings.

3. Consider Warehousing Options

If your business plans to import machinery in large volumes, exploring warehousing options can assist in deferring tariffs until the equipment is needed.

The Role of Brokers in Importing Machinery

Navigating the complexities of importing machinery, including understanding tariffs, can be daunting. Hiring a licensed customs broker can prove invaluable. These professionals help ensure compliance with regulations, optimize documentation, and facilitate more efficient import processes. They serve as mediators between businesses and government authorities, ensuring that your interests are represented thoroughly.

Documentation Required for Importing Pick-and-Place Machines

To import pick-and-place machines successfully, several key documents are typically required:

- Commercial Invoice: A bill for the goods from the seller to the buyer, detailing specifics about the machinery.

- Bill of Lading: A legal document between the shipper and carrier documenting the goods being carried.

- Cargo Insurance: Proof of insurance that covers any potential loss or damage to the machinery during transport.

- Customs Declaration: A comprehensive form detailing the nature of the goods being imported.

Future Trends in Import Tariffs for Machinery

As trade dynamics continue to evolve, so too will import tariffs for machinery, including pick-and-place systems. Observing trends such as the growing emphasis on automation and international trade flexibility, businesses must remain vigilant and adaptable. Economic shifts and political decisions will likely impact tariffs, highlighting the need for ongoing education and professional advice.

In summary, understanding the intricacies of import tariffs for pick-and-place machines is crucial for any business looking to expand its operations through automation. By researching tariff rates, utilizing strategies to minimize expenses, engaging competent customs brokers, and maintaining awareness of changing regulations, you can successfully navigate the complexities of importing this essential machinery. Keeping informed will empower businesses to achieve their operational goals while minimizing costs, ultimately facilitating more streamlined production capabilities.