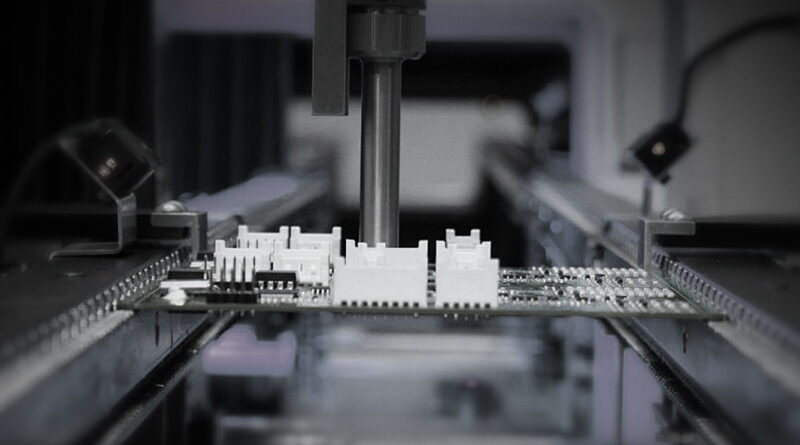

In the world of surface mount technology (SMT), your pick and place (P&P) machine is the heartbeat of production. The price you pay is more than a number on a quote—it reflects speed, accuracy, scalability, and total cost of ownership. Whether you’re a startup prototyping boards, a small contract manufacturer, or a mid‑size EMS aiming to expand throughput, understanding the price landscape helps you map a realistic roadmap. This guide pulls together current market realities, common price bands, and practical buying decisions to help you budget for a reliable SMT line that meets your goals.

Quick price snapshots: what you might expect right now

Prices for pick and place machines vary widely by capability, brand, and whether the unit is new or used. Based on recent listings and industry chatter, here are representative anchors you can use to scope your planning:

- Entry-level desktop or compact mass-production models: roughly $9,995 to $15,000. These are often smaller, highly integrated units with limited feeder capacity and modest placement speeds, aimed at prototyping or very small batches. Example ranges observed for compact machines span around $9,995 to $13,499 in current marketplaces.

- Mid-range, fully functional standalone P&P units for smaller EMS lines: typically $25,000 to $60,000. These systems commonly offer more feeders, better vision tooling, and higher placement rates, making them attractive for pilot lines or small jobs that require reliable throughput without a full production line.

- Better-equipped mid-range to near‑premium desks: around $60,000 to $120,000. In this band you’ll find more robust feeders, multiple heads, enhanced vision systems, and improved tolerance on accuracy. Some models even unlock inline inspection options or basic boards handling capability for mini-production runs.

- High-end, production-grade P&P machines or complete lines (including AOI, SPI, and board handling): $200,000 to $800,000 and beyond. The full mid-range line, including feeders, software, and integration with reflow, inspection, and conformal coating, often falls in this tier. Industry guidance consistent with market reports suggests this is the typical spectrum for serious production environments.

- Used or refurbished equipment: widely variable, from a small fraction of new price to well over half depending on age, maintenance, and documentation. You may encounter listings across a broad spectrum, including some novelty finds that carry very low price tags but require careful due diligence.

Note: Price ranges are approximate and can vary by region, currency, vendor promotions, component availability, and the specific feature set included with the machine. In practice, a single model can land anywhere within these bands depending on whether it is new, refurbished, or sold with added peripherals such as feeders, software, and support contracts.

What actually drives the price: core factors explained

To invest wisely, you need to understand the levers of cost. Here are the most influential factors that determine the price of a pick and place machine and the total cost of ownership over its life:

- Placement speed and throughput: Measured as components per hour (CPH) or seconds per placement, speed improvements require more sophisticated hardware, faster vision, and higher torque motors. Faster machines cost more, but they often pay back quickly on high-volume programs.

- Accuracy and head count: Precision down to 0.01 mm or better often requires advanced optics, better calibration, and sometimes more heads. Multi-head configurations dramatically increase price but reduce cycle times on complex boards.

- Vision system and alignment: Machines with high‑quality vision systems, fiducials, 2D/3D inspection integration, and self-learning alignment add cost but dramatically improve yield, especially on small components or dense PCBs.

- Feeder capacity and compatibility: The number and type of feeders (tape-and-reel, tray, and tube) and their compatibility with varying PCB sizes influence both upfront price and replenishment cost. Large feeder banks enable longer uninterrupted runs but add to purchase price.

- Board handling and routing: Inline board handling, universal feeders, and PCB transport mechanisms add mechanical complexity and price. Inline docking with PCB depanelization, stamping, or carrier systems also impacts cost.

- Software ecosystem: Programming, optimization, and offline placement software licensing, library management, and machine-to-machine connectivity can shape lifetime costs. Some vendors bundle software or reduce annual maintenance if you commit to a long-term service contract.

- Reliability, warranty, and service: Brand reputation, factory support, response time, and extended warranties are priced into higher-end machines. This is a critical area if you operate mission-critical lines with minimal downtime.

- New vs used and refurbishments: Used units often sit at a fraction of new price but may require more maintenance, updates, and risk of downtime. Refurbished units with certified maintenance packages can offer a favorable balance.

- Peripheral integration: Solder paste inspection (SPI), automated optical inspection (AOI), reflow ovens, handling robots, and conformal coating add to the total package when you aim for a complete SMT line rather than a single standalone machine.

Budget planning: choosing a price band that fits your goals

Different business scenarios demand different price bands. Consider these archetypes to guide your planning:

- Startup prototyping and hobbyist-to-small-batch manufacturing: If you’re validating designs or producing limited runs, a compact, budget-oriented machine in the range of $10k to $20k can be appealing. Expect limited feeder banks, smaller boards, and slower throughput, but you can achieve fast ROI on small volumes with careful workflow.

- Small to mid-size EMS or in-house production: A mid-range solution in the $40k–$100k bracket typically delivers a better mix of speed, accuracy, and reliability. You’ll find machines around $30k-$60k that balance cost with feature sets such as enhanced vision, more robust feeders, and decent uptime.

- Growing manufacturing with higher throughput: If your line is expanding beyond prototyping, target a high-end mid-range to premium P&P unit or even a line package around $150k–$400k. Expect multi-head configurations, larger feeder banks, more advanced vision, and better service agreements.

- Full production line or high-mix/low-volume with full automation: For serious, continuous manufacturing, a complete line or an advanced P&P with inline inspection, board handling, and integration to conveyers often lands in the $200k–$800k range or higher. ROI hinges on sustained throughput and reduced downtime across the line.

New vs used, refurbished vs lease: navigating buying options

Here are practical considerations for different sourcing paths:

- New machines: Best for long-term reliability, warranty coverage, and the latest control software. They come with full vendor support and updated parts, but price is higher and lead times can be longer.

- Used or refurbished machines: They can deliver substantial upfront savings, but require careful due diligence. Look for documented maintenance history, known component replacements, and a clear path to spare parts. If possible, obtain a verified service report and a trial or test run before committing.

- Leasing and financing: Spreading investment over time helps with cash flow and can align with production ramps. Many vendors offer financing programs, maintenance plans, and upgrade options that can reduce the effective cost of ownership.

- Trade-ins and bundle deals: Some vendors provide trade-in options for older equipment or bundle deals with feeders, software, and service contracts. This can improve total cost of ownership and speed up deployment.

Brand landscape: what to expect from different manufacturers

Brand choice often correlates with reliability, service reach, and total cost of ownership. Each tier has typical strengths:

- Low-cost / entry-level brands: These are popular for startups and prototyping. Expect compact footprint, easier setup, and lower upfront price. Features may be simplified, and support may be more limited outside of standard packages.

- Mid-range brands: A balanced option offering better feeders, speed, and software with reasonable price points for growing shops. They are frequently chosen by small EMS providers seeking consistent performance without premium pricing.

- Premium brands (e.g., well-known industry leaders): Generally provide robust reliability, large feeder banks, advanced vision, multi-head arrangements, and global support networks. They carry higher price points but often deliver lower downtime and stronger resale value.

Recent market snapshots show a mix of brands at various price points. For example, compact options from newer manufacturers can supply strong value around $10k–$15k, while established mid-range lines might sit in the $40k–$120k window. High-performance lines from leading brands can exceed $200k, reflecting the added capabilities and global service. Always verify features like feeder count, head configuration, tuning, and software maturity when comparing brands.

ROI and total cost of ownership: turning price into business value

Price is just the entry point. To understand true value, model return on investment (ROI) and total cost of ownership (TCO) over the machine’s life. Consider:

- Throughput and wage savings: How many boards per hour can you place, and by how much can you reduce manual labor or rework? A faster P&P that minimizes mistakes often pays back quickly in high-volume scenarios.

- Yield improvements: Higher accuracy and better vision reduce defects. In a low-margin business, even small yield gains translate into meaningful profit improvements over time.

- Downtime risk and maintenance: Research the vendor’s support response time, spare parts availability, and preventative maintenance requirements. A robust service package reduces unexpected outages and hidden costs.

- Software and updates: Ongoing licensing costs can add to the annual expense. Some vendors include software updates in maintenance, while others require recurring payments.

- Depreciation and tax incentives: Depending on your jurisdiction, capital investment depreciation and tax incentives may reduce the effective price over time.

To illustrate, a small shop upgrading from a hobbyist setup to a mid-range P&P might see a period of months before achieving ROI, especially if they also invest in minimal inline inspection and board handling. In contrast, a growing EMS with a multi-head, high‑speed line may justify a premium system within a single production cycle, thanks to higher throughput, better yields, and a shorter payback window.

Buying checklist: how to compare offers like a pro

When you request quotes, use a consistent checklist to ensure apples-to-apples comparisons and avoid hidden costs. Key questions to ask vendors include:

- What is included in the base price (feeders, software license, warranty period, service terms)?

- How many feeders does the standard model support, and what are the cost and lead times for additional feeders?

- What is the maximum board size and component range supported? Are there limitations on fine-pitch devices?

- What is the stated placement speed (CPH) and typical accuracy under real-world conditions?

- What kind of vision system and alignment tools are installed, and are there optional upgrades?

- What is the recommended maintenance schedule, and are on-site service visits included in the contract?

- Is there a trial or short-term test option to validate performance on your actual boards?

- What is the total cost of ownership over five to ten years, including software licensing, spare parts, and upgrades?

- Are there any financing, leasing, or trade-in options, and what are the terms?

Where to buy: a one-stop approach with strong support

For many buyers, selecting a vendor who can provide a complete SMT solution—from pick and place to soldering and inspection—simplifies procurement, reduces integration risk, and improves after-sales service. A one-stop supplier can offer:

- Integrated product lines that ensure compatibility across feeders, boards, and peripherals

- Coordinated pre-sales support, on-site demonstrations, and production trials

- Coherent maintenance packages, spare parts availability, and remote diagnostics

- Clear upgrade paths as your production needs evolve

In practice, many buyers lean toward providers that offer a broad ecosystem and robust post-sales support. The market includes a mix of well-known brands and integrators who curate a complete SMT solution. A reputable provider will also be transparent about lead times, customization options, and regional service coverage.

Industry context: what today’s market looks like (and what it might do next)

The SMT equipment ecosystem is dynamic. New software features, improved camera resolution, and smarter nozzle handling are becoming more accessible at lower price points, while core manufacturing expectations push average line speeds higher and yields lower. As you plan future investments, consider not only current production volume but anticipated scaling, product mix, and the need for automation. The market has shown that robust mid-range lines can deliver solid performance for growing shops, while top-tier production lines remain indispensable for high-mix, high-volume environments. The trend toward integrated lines with inline inspection and automated handling continues to influence pricing, with total package costs often appearing as a strategic consideration rather than a single item.

Real-world pricing anecdotes from reputable sources illustrate a spectrum: compact machines around the five-figure mark, mid-range portfolios in the low six figures, and enterprise-scale lines pushing into the upper six figures to seven figures when fully integrated. These numbers reflect not just hardware, but the value of service, support, and networked automation that keeps a line running with minimal downtime.

NECTEC: a one-stop partner for SMT solutions you can trust

NECTEC positions itself as a premier destination for comprehensive SMT solutions. The company emphasizes integration of the most valuable suppliers worldwide to address every stage of PCB assembly—from printing and placing to soldering, inspection, conformal coating, and peripheral consumables. They highlight strict quality control across production stages and a dedicated pre-sales team available 24/9 to help customers overcome purchasing barriers and secure the best possible outcomes. Post-sales service is designed to maintain and enhance customer satisfaction through ongoing support. If you’re evaluating options, a one-stop partner like NECTEC can simplify procurement, accelerate deployment, and provide a unified path to upgrade as your production demands evolve.

Putting it all together: your step-by-step plan to price‑smart purchasing

- Define your production goals: daily throughput, board complexity, and defect tolerance. This frames the required speed, accuracy, and feeder capacity.

- Create a realistic budget envelope: separate initial capital for hardware from ongoing costs for software, maintenance, and consumables.

- Identify must-have features: vision, inline inspection, multi-head configuration, large feeder banks, and board handling options that match your product mix.

- Ask for trials or demonstrations: verify performance on your actual boards, particularly for fine-pitch components or tight tolerances.

- Compare total cost of ownership: request a five-year TCO breakdown including maintenance, spares, software licenses, and upgrade pathways.

- Explore financing and upgrade options: consider leasing or staged investments so the line can ramp with demand.

- Plan for integration: ensure compatibility with reflow, AOI, SPI, and any conformal coating processes you plan to run.

- Build a conservative risk plan: include contingencies for spares, downtime, and supplier support so you’re not caught off guard if lead times shift.

Final thoughts: making a confident choice in a crowded market

Choosing the right pick and place machine price point isn’t about chasing the cheapest option or chasing the most expensive brand. It’s about aligning capability with your actual production needs, balancing upfront capital with sustainable operating costs, and securing a partner who can scale with you. For most shops, a plan that starts with a dependable mid-range solution—backed by solid service, adequate feeder capacity, a capable vision system, and an accessible upgrade path—tends to deliver the best blend of speed, accuracy, reliability, and cost efficiency. Don’t overlook the value of integrated support and the peace of mind that comes with a trusted supplier who can guide you from the first demo through a fully automated production line.

If you’re seeking guidance tailored to your board mix, throughput targets, and budget, consider reaching out to a one-stop provider like NECTEC. Their team, backed by a global network of suppliers and a commitment to quality, can help you design a price- and performance-appropriate SMT solution that grows with you. Your next production upgrade should be an investment that compounds value—delivering faster builds, higher yields, and a stronger competitive edge for years to come.

Disclaimer: All price ranges referenced in this guide are indicative and may vary by region, vendor, and configuration. Verify current quotes and confirm included accessories before finalizing any purchase.