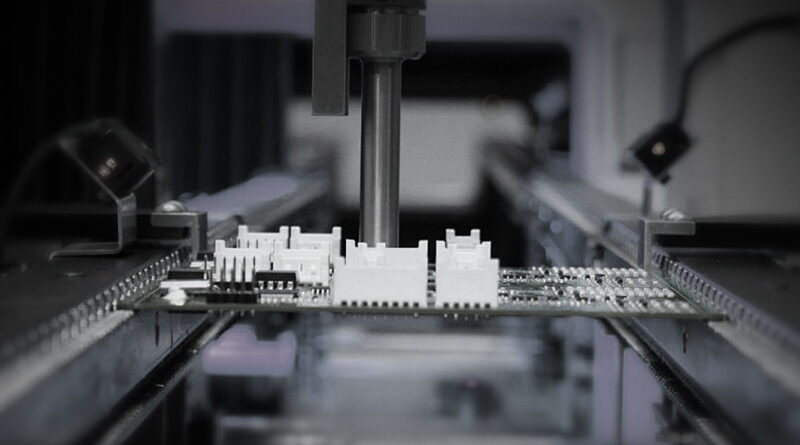

In the evolving landscape of manufacturing and automation, pick and place machines stand out as pivotal equipment in the assembly process. These machines enhance efficiency and precision, but like all assets, they experience a decline in value over time. Understanding the depreciation rates of pick and place machines is crucial for manufacturers, accountants, and business owners wishing to maximize their investment returns. This guide aims to break down the concept of depreciation in relation to pick and place machines, exploring factors that influence depreciation rates, methods to calculate them, and strategies for managing depreciation effectively.

What is Depreciation?

Depreciation is an accounting method for allocating the cost of a tangible asset over its useful life. In simpler terms, it accounts for the wear and tear of an asset over time. For businesses, depreciation impacts net income and tax liabilities, providing a beneficial deduction that effectively lowers taxable income. For pick and place machines, understanding how depreciation works can inform purchase decisions, financing, and overall asset management strategies.

Why Depreciation Matters for Pick and Place Machines

For manufacturers using pick and place machines, depreciation represents not only an accounting practice but also a financial reality. It influences capital investment decisions, budgeting, and planning for turnover and upgrades. Additionally, accurate depreciation assessment can assist in the sale or trade-in of older equipment, giving businesses leverage in negotiations.

Factors Influencing Depreciation Rates

Several factors can affect the depreciation rate of pick and place machines, including:

- Initial Cost: The more expensive the asset, the more substantial the depreciation.

- Useful Life: The estimated lifespan of the machine influences how quickly its value will be depreciated.

- Wear and Tear: Machines used continuously in high-volume production may depreciate faster due to increased wear.

- Technological Advances: Rapid changes in technology can render older equipment less valuable.

- Market Demand: Fluctuations in market demand for specific machine types can affect their resale value.

Methods of Calculating Depreciation

There are several methods to calculate depreciation, each suitable for different business contexts. The most common methods include:

1. Straight-Line Depreciation

This simplest method spreads the cost evenly across the useful life of the machine. For example, if a pick and place machine costs $100,000 and has a useful life of 10 years, the annual depreciation expense would be $10,000.

2. Declining Balance Method

This accelerated method applies a constant percentage to the remaining book value of the asset each year. For example, using a double declining balance method, if the same machine costs $100,000, it may depreciate by 20% of its remaining value annually, leading to larger deductions in the early years.

3. Units of Production Method

This method ties depreciation to the actual usage of the machine. For pick and place machines, depreciation can be calculated based on the number of placements or cycles, making it a particularly relevant approach in high-demand settings.

Understanding Useful Life and Salvage Value

Determining the useful life of a pick and place machine is a critical aspect of the depreciation calculation. Typically, manufacturers assess their machines’ expected lifespan based on industry standards, past experiences, and the machine’s condition. In addition, estimating salvage value—the anticipated resale value at the end of its useful life—is vital, as it influences the total depreciation calculation. A high salvage value will result in lower depreciation, whereas a low salvage value will increase depreciation expenses.

Industry Benchmarks for Depreciation Rates

According to industry studies, pick and place machines typically have a useful life ranging from 10 to 15 years. The depreciation rates for these machines can average around 10-20%, depending on the aforementioned factors. It is beneficial for businesses to cross-reference their depreciation rates with industry benchmarks to ensure effective asset management practices.

Implications for Business Strategy

Understanding depreciation not only aids in accounting practices but also informs strategic planning for businesses. Here are some implications:

1. Budgeting for Equipment Upgrades

Knowing depreciation rates can help businesses set budgets for future equipment upgrades or investments. By anticipating the decline in value, they can allocate funds wisely.

2. Financial Reporting

Accurate depreciation accounting affects financial reporting and can give stakeholders a clearer picture of equipment efficiency and productivity.

3. Tax Planning

Businesses can use depreciation deductions to plan for taxes strategically, ensuring they maximize their savings.

Best Practices for Managing Depreciation of Pick and Place Machines

Here are some best practices when managing depreciation for these machines:

- Regular Maintenance: Keep machines well-maintained to prolong their useful life and optimize performance.

- Accurate Record-Keeping: Maintain detailed records of all costs associated with each machine, including maintenance, repairs, and upgrades, to provide a comprehensive view of asset performance.

- Regular Re-evaluation: Periodically assess the machine’s condition and market trends to adjust depreciation methods or rates as needed.

The Future of Pick and Place Technology and Its Impact on Depreciation

As technology advances, pick and place machines are becoming increasingly sophisticated, incorporating artificial intelligence and robotics. While improvements enhance productivity, they also create challenges in depreciation management. Manufacturers will need to be adaptive, constantly re-evaluating their assets’ useful lives and valuation metrics.

In closing, understanding the depreciation rates for pick and place machines is integral to the manufacturing landscape. Whether it is managing the finances of existing machinery or planning for future investments, a solid grasp of depreciation concepts enables business leaders to make informed decisions that can lead to enhanced efficiency and profitability.