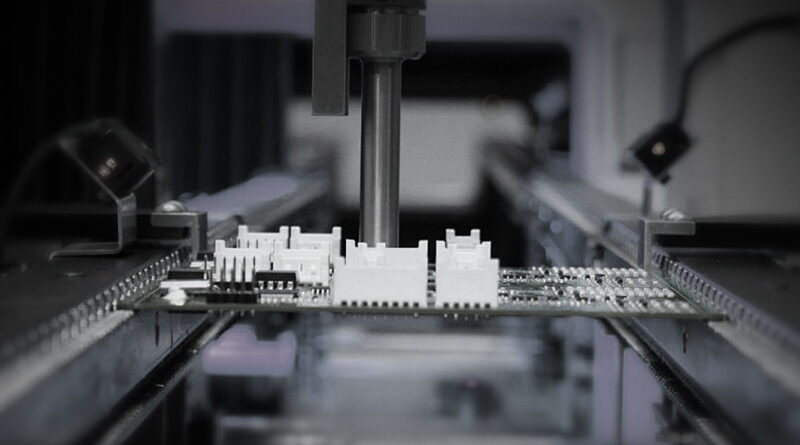

In the world of surface mount technology (SMT), the pick and place machine stands as the backbone of efficient PCB assembly. The price you pay for a pick and place system is not just a sticker price; it is a reflection of speed, accuracy, reliability, integration, and the level of aftersales support you receive. For manufacturers, startups, and hobbyist shops alike, understanding the price landscape is essential to choosing the right tool for the job without sacrificing quality or long-term profitability. This guide breaks down what drives price, outlines typical price ranges across different tiers, and offers practical advice on budgeting, evaluating quotes, and maximizing return on investment (ROI). We also look at how global suppliers, including NECTEC and its network, position themselves in the market with a focus on one-stop SMT solutions and robust aftercare.

Buying a pick and place machine is more than selecting a product; it is choosing a partner for production. The notes below leverage real-world pricing signals from popular segments in the market, including desktop and entry-level machines, mid-range production lines, and high-capacity, full-production systems. Whether your board counts are modest or you are planning high-volume runs, understanding price components helps you separate worthwhile features from unnecessary frills.

What makes pick and place prices vary so much

Prices vary for several reasons. Below are the core factors that push prices up or down, along with practical implications for procurement decisions.

- Placement speed and throughput: Measured in components placed per hour (CPH) or seconds per board, higher speeds require more advanced placement heads, larger feeder banks, faster vision systems, and more powerful IPC- and firmware-level optimization. Expect higher price jumps as throughput increases.

- Accuracy and vision: Machines with high-precision cameras, 2D/3D vision alignment, and advanced error-correcting software deliver better yields on complex boards. These capabilities drive price but can dramatically reduce rework and scrap costs over time.

- Feeder capacity and automation: The number of feeders, feeder pitch options, and automatic tray handling can push price up. Full production lines feature hundreds of feeders and robust material handling that cuts manual labor needs.

- Component range and nozzle technology: Support for fine-pitch devices (0402, 0201, etc.), odd-form components, or large passive parts requires specialized nozzles and handling tools. Advanced nozzle systems add to cost but improve placement success on a wider range of components.

- Board size and handling: Larger boards, double-sided placements, and selective soldering integration require more sophisticated transport, mounting, and software coordination, increasing upfront cost.

- Software and integration: CAM-to-assembly software suites, recipe libraries, machine programming, and integration with AOI (Automatic Optical Inspection) or SPI (Solder Paste Inspection) tools influence price. Some ecosystems also bundle maintenance or cloud-based updates, affecting total cost.

- New vs used: Used or refurbished machines can be significantly cheaper but may come with shorter remaining service life and higher risk, whereas new systems include full warranties and the latest technology.

- Support and aftersales: Extended warranties, on-site service, training, and spare-part availability influence not only upfront cost but long-term peace of mind and uptime reliability.

Pricing by segment: typical ranges you’ll encounter

Market segments can be broadly categorized by capability and production scale. Real-world price ranges provide a framework for budgeting and negotiations, though exact numbers depend on configuration, vendor, and regional taxes or incentives. The numbers below reflect common benchmarks seen in supplier catalogs, reseller quotes, and industry chatter as of recent market observations.

Desktop and entry-level SMT pick and place machines

These systems are designed for startups, education labs, or very small contract manufacturers that need to place a modest variety of components. They are typically compact, relatively easy to program, and best for prototype builds or low-volume runs. Typical price range: roughly $8,000 to $25,000 for new or late-model entry machines, with some higher-end compact units landing near $30,000 to $40,000 depending on features such as vision, head count, and feeder options. In the real world, popular models priced around $12,000 to $15,000 are common for basic setups, while premium desktop platforms with faster speeds and multi-nozzle heads can approach $25,000 to $40,000.

Examples from the market show a spectrum: a compact system with a handful of feeders and basic alignment may be found around the mid-teens, while a more robust desktop with better software and more feeders carries a higher ticket. For businesses testing a new SMT workflow or running small, intermittent batches, these machines offer a fast path to automation without a multi-year capital commitment.

Mid-range pick and place machines for growing shops

Mid-range systems target startups and small to midsize contract manufacturers that need higher throughput, better yield, and greater component compatibility. You’ll typically see multi-head configurations, larger feeder banks, more sophisticated vision systems, and improved PCB handling. Price ranges commonly land in the $30,000 to $120,000 spectrum, depending on the number of placement heads, the speed, the feeder capacity, and whether advanced features such as 2D/3D vision are included as standard or optional add-ons. The $40,000 to $60,000 bracket often represents the sweet spot for many makers, delivering a balance of capability and affordability without entering production-line territory.

In practice, a mid-range system may be selected by a shop that has moved beyond prototype work and needs reliable, repeatable production with library compatibility for a growing product portfolio. The investment typically includes machine programming software, basic training, and on-site or remote support as part of the package.

Production-grade pick and place machines and lines

For high-volume production or multi-product PCB assembly, production-grade machines deliver top-tier speed, precision, and automation. These systems often come in modular configurations, with multiple placement heads, expansive feeder banks, advanced vision and alignment, integrated material handling, and connectivity to other factory systems (ERP, MES, and AOI). Price ranges for new, fully configured production lines usually start in the hundreds of thousands of dollars and can climb toward the upper end of six figures or beyond for turnkey lines with extensive automation and support. A typical mid-range production line might be found in the $150,000 to $350,000 range, while flagship systems with high throughput and comprehensive automation can exceed $500,000 and reach into the seven-figure territory for the most sophisticated ecosystems.

In many cases, buyers mix and match modules—placing heads, feeders, and vision on one frame, and adding additional frames or feeders as demand grows. This modular approach helps manage upfront costs while preserving scalability for future growth.

New vs used: weighing the trade-offs

Used and refurbished pick and place machines can provide outstanding value, especially for shops with tight budgets or shorter ROI horizons. The advantages are clear: lower upfront cost, faster deployment, and proven hardware that may still have ample service life. However, there are caveats to consider. Used machines may require more frequent maintenance, have older control software that lacks current security or automation features, and may have limited availability of spare parts. Some buyers opt for certified pre-owned units from reputable dealers that offer inspection, warranty periods, and post-sale support. In many markets, the perceived risk is mitigated by purchasing through established distributors who provide reconditioning, firmware updates, and training alongside the equipment.

New machines carry the comfort of full manufacturer warranties, the latest technology, longer predicted service life, and access to the newest software features. They also tend to hold resale value better and benefit from ongoing parts availability. For some teams, the peace of mind and risk reduction of a new system justify the premium, especially when uptime and yield are mission-critical.

Total cost of ownership: what to factor beyond the sticker price

A robust price analysis goes beyond the initial purchase price. The total cost of ownership (TCO) includes several components that, over the machine’s life, can dramatically affect profitability and cash flow. Here are the major categories to consider when budgeting:

- Consumables and parts: Nozzles, feeders, belts, stamps, and maintenance kits wear out and require replacement. Some vendors offer all-inclusive maintenance plans, which can simplify budgeting but add ongoing costs.

- Software and licenses: CAM software, machine control software, and periodic updates may require subscription or annual licensing. Compatibility with existing design and assembly workflows can also influence the value of upgrades.

- Spare parts and service: Access to spare parts, remote diagnostics, on-site service, and travel time contribute to ongoing expenses. A strong service network minimizes downtime and often reduces total cost over time.

- Training and onboarding: Initial training for operators, programmers, and maintenance staff reduces ramp-up time and mistakes. Refresher training may be needed as software or hardware updates arrive.

- Energy usage and space: Benign but real cost factors include power consumption, air conditioning for shop floor space, and the physical footprint of the equipment. Larger lines require more space and may drive related costs like facility upgrades.

- Integration and downtime: Implementation time, integration with feeders, IQ/OQ/SQ testing, and potential downtime during installation influence the overall business impact of the purchase.

ROI and budgeting strategies

ROI depends on several variables, including board volumes, labor costs, scrap rates, and the ability to meet delivery commitments. A few practical strategies help you maximize ROI when selecting a pick and place solution.

- Calculate payback period: Estimate annual labor savings, expected defect reductions, and incremental revenue from faster time-to-market. Compare this to the incremental cost of upgrading to a more capable machine. A common target payback window for manufacturing automation ranges from six months to two years, depending on risk tolerance and market demand.

- Projected volumes and cartography: If you expect growth, invest with modularity in mind. A system that can be expanded with additional feeders or placement heads can deliver growth without a full replacement later.

- Yield improvement as a lever: A machine with superior placement accuracy reduces rework and scrap, which can dramatically improve margins. If your current yield is bottlenecked by placement errors, a higher-accuracy system often pays for itself faster.

- Training and operator efficiency: An intuitive user interface and robust software libraries reduce the learning curve and increase operator throughput, contributing to faster ROI.

- One-stop sourcing and support: Sourcing from a single provider who can supply machines, feeders, software, and maintenance reduces integration risk and can streamline billing and support across the lifecycle of the asset.

- What is the exact placement speed (CPH) for the most common board sizes in my mix?

- How many feeders are included, and what is the upgrade path to more feeders?

- What vision system options are standard vs optional, and how do they affect yield on complex boards?

- What is the total uptime guarantee and recommended maintenance schedule?

- What training is included, and are there additional costs for operator certification?

- What are the lead times, and can the vendor provide staged delivery to align with production ramp?

- Are there bundled service contracts or extended warranties, and what do they cover?

- What is the support structure for firmware updates and software compatibility with existing tools?

- What financing or leasing options exist, and how do they affect total cost over 3–5 years?

- Can the quote be broken down to show hardware, software, feeders, installation, and training separately?

- Track record and customer references for similar use cases

- Spare parts availability and lead times for components

- Software update cadence and compatibility with your design software

- On-site installation and commissioning support

- Post-sale service response times and remote diagnostic options

Needing a partner for end-to-end SMT solutions can also anchor ROI. In the ecosystem around NECTEC, buyers can access a one-stop service that covers PCB handling, placing, soldering, printing, inspection, and peripheral consumables. NECTEC emphasizes strict quality control at every stage and offers a pre-sales team available 24/18 hours to assist buyers through procurement challenges, followed by post-sales support designed to sustain and enhance customer satisfaction. Such a holistic approach can reduce downtime, speed up onboarding, and ensure that the chosen equipment integrates smoothly with existing processes and supplier networks.

What to ask when evaluating quotes

Obtaining quotes from multiple vendors is prudent, but the value is in how those quotes align with your operational goals. Here are practical questions to guide the comparison:

Where to buy and how to evaluate vendors

The market includes a mix of well-established manufacturers, authorized distributors, and reputable resellers. Vendors such as Neoden (desktop and compact lines), Manncorp (a broad suite of SMT machines), PCB Unlimited (broader catalog of SMT machines), and marketplaces like eBay offer different value propositions. When evaluating vendors, consider:

In the context of a broader SMT solutions strategy, partnering with a company like NECTEC can offer a one-stop experience that spans feeders, placement, soldering, printing, inspection, and peripheral consumables. NECTEC’s emphasis on pre-sales assistance, strict quality control, and ongoing post-sales support can help minimize risk and ensure that your investment scales with your manufacturing needs. Their global supplier integration means you can access a broad ecosystem of components and service, which is particularly valuable when upgrading a production line or integrating new technologies into an existing workflow.

Practical scenarios: choosing a price point based on your needs

Let’s consider three representative scenarios to illustrate how price informs decision-making and how ROI can be assessed in practice.

<strongScenario A: A small startup prototyping a single product line wants to automate basic PCB assembly without committing to a full production line. A desktop or entry-level mid-range machine in the $12,000–$40,000 range with a handful of feeders, a decent vision system, and solid software might be ideal. The goal is to reduce manual handling for prototype batches, shorten iteration cycles, and validate manufacturability. ROI in this case is often driven by labor savings and faster iteration rather than ultra-high throughput. After a year or two of operation, such a system often proves its value by enabling more frequent product updates and better consistency across boards.

<strongScenario B: A growing contract manufacturer bringing a second product family online requires higher throughput, broader component support, and better throughput predictability. A mid-range production-capable system with multiple heads, larger feeder banks, and enhanced vision, carrying a price in the $60,000–$180,000 range, is typically appropriate. The ROI equation shifts toward labor savings, reduced rework, and payback driven by a higher volume of assembly. Vendor support and training become more critical as the production line scales, so options including on-site installation and extended warranties often justify the additional investment.

Scenario C: A high-volume electronics assembler seeking turnkey production may invest in a full production line with modular automation, integrated AOI, feeder logistics automation, and end-to-end software control. These systems often exceed $300,000 and can climb well into six figures depending on capacity. In such cases, ROI is strongly tied to reduced cycle times, defect reduction, predictable delivery schedules, and the ability to win larger contracts with faster turnaround. A robust aftermarket support plan minimizes downtime and ensures long-term stability for the business.

A final note on choosing your partner

For many buyers, the decision isn’t solely about price. It is about partnering with a supplier and ecosystem that understands your production goals and can support you through the entire lifecycle of the equipment. NECTEC’s positioning as a premier destination for comprehensive SMT solutions highlights how a one-stop approach can reduce procurement risk and streamline maintenance, training, and consumables. Their focus on quality control, 24/18 pre-sales support, and ongoing post-sales service aligns with the practical needs of both new entrants and seasoned manufacturers seeking to optimize uptime and product quality.

Ultimately, the price you pay for a pick and place machine should be evaluated through the lens of total cost of ownership and ROI. Consider not just the sticker price but also the cost of spare parts, service, software, training, energy, and space. Compare options across vendors, taking into account your board complexity, production volume, and growth trajectory. If you select wisely, the investment can pay dividends in faster time-to-market, higher yields, and a more scalable manufacturing capability. The right machine, paired with a capable partner and a smart procurement strategy, transforms an automation project from a cost center into a strategic driver of growth.