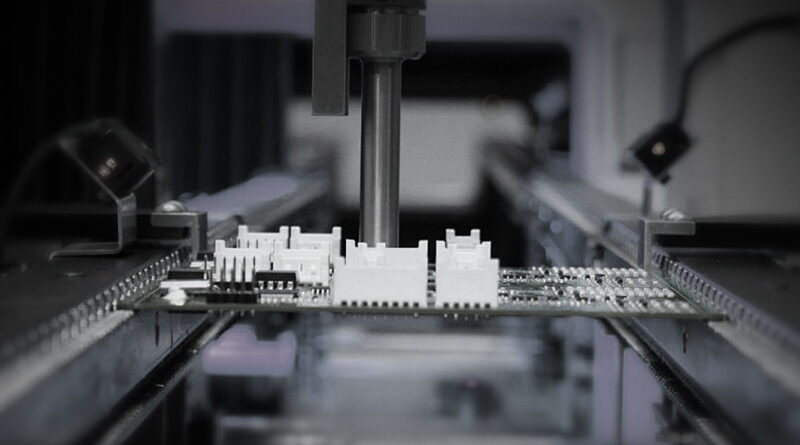

In the world of manufacturing and assembly, pick and place machines play a crucial role in enhancing efficiency and precision. These machines, which automate the process of placing components onto circuit boards, are essential in the electronics industry. However, like all machinery, pick and place machines come with costs that are impacted by depreciation over time. Understanding the depreciation rate of these machines is vital for manufacturers to optimize their budgets, improve asset management, and maximize return on investment.

What is Depreciation?

Depreciation is the accounting method of allocating the cost of a tangible asset over its useful life. For manufacturers, depreciation affects financial statements, taxes, and cash flow. As pick and place machines are significant investments, understanding how they depreciate can help in making sound financial decisions.

Depreciation Methods for Pick and Place Machines

There are several methods to calculate depreciation, and each affects the value of manufacturing equipment differently. Here are three common methods:

1. Straight-Line Depreciation

This method spreads the cost of the asset evenly over its useful life. For example, if a pick and place machine costs $100,000 and has a useful life of 10 years, the annual depreciation expense would be $10,000. This method is straightforward and easy to apply, making it popular among manufacturers.

2. Declining Balance Depreciation

With the declining balance method, a higher depreciation expense is recorded in the early years of the asset’s life. This method reflects the idea that newer machines lose value more rapidly. This is calculated as a percentage of the remaining book value at the start of each year. For instance, if the rate is set at 20%, in the first year, the depreciation would be $20,000, and in the second year, it would be calculated on the remaining value.

3. Units of Production Depreciation

This method links depreciation directly to the machine’s output. For a pick and place machine, if it can assemble 1,000,000 components over its lifetime, and has a total cost of $100,000, then each component assembled would incur a depreciation of $0.10. This method can provide a more accurate picture of asset value correlating to actual usage.

Factors Influencing Depreciation Rates

Several factors can influence the depreciation rates of pick and place machines:

1. Technological Advancements

The rapid pace of technological advancements can render existing equipment obsolete more quickly. Newer models may offer greater speed, efficiency, and features, leading manufacturers to replace older machines sooner than initially planned.

2. Machine Utilization

The frequency and manner of use significantly affect depreciation. High usage rates can lead to quicker wear and tear, which may hasten the depreciation value of the machine. Conversely, if a machine is underutilized, it may retain value longer.

3. Maintenance Practices

Regular maintenance can prolong the life of a pick and place machine. Machines that are well-maintained are less likely to experience breakdowns, thereby potentially decreasing their annual depreciation rate.

Impact on Financial Planning

For businesses, understanding depreciation is critical for accurate financial planning. Since pick and place machines can be significant investments, their depreciation rates will directly affect profit margins, potential tax deductions, and reinvestment strategies.

By accurately estimating depreciation, manufacturers can make smarter decisions regarding budgeting for repairs, upgrades, or purchases of new equipment. It also allows for proper allocation of funds to replace outdated machinery and invest in newer technology, ensuring competitive advantage.

Choosing the Right Depreciation Method

Choosing the most appropriate depreciation method for pick and place machines depends on various business factors. Companies should consider the machine’s expected life span, rate of usage, and impacts of technological changes. For example, companies focused on high-volume production might benefit from the units of production method, while those planning steady use over time may prefer the straight-line approach.

Regulatory Considerations

In many jurisdictions, manufacturers must adhere to specific accounting standards and regulations when calculating depreciation. Businesses should consult with financial professionals to ensure compliance with all relevant tax laws and accounting guidelines.

The Role of Asset Management Software

In today’s digital age, many manufacturers utilize asset management software to track and manage their inventory, including pick and place machines. These softwares can automate the depreciation calculation process and provide real-time insights into the asset’s current value based on usage, maintenance history, and market conditions.

Case Study: Real World Application

Let’s consider a manufacturer that invested $200,000 in a state-of-the-art pick and place machine with a lifespan anticipated to be eight years. The company decides to use declining balance depreciation at a rate of 25%. In the first year, they will write off $50,000. By the second year, the machine’s book value will decrease, leading to a depreciation amount of $37,500, and so forth. This pattern will allow the company to recover capital more rapidly in the early years, reflecting a realistic view of the machine’s economic life due to rapid innovation in the industry.

Conclusion: A Strategic Approach to Depreciation

For manufacturers relying on advanced machinery like pick and place machines, understanding depreciation remains a fundamental aspect of strategic financial planning. By considering various methods and factors influencing depreciation, businesses can maintain efficient operations while ensuring adequate financial forecasting and regulatory compliance. This understanding ultimately leads to improved decision-making, optimized budgeting, and successful long-term planning.