In der sich ständig weiterentwickelnden Welt der Fertigung ist das Verständnis der finanziellen Aspekte von Maschinen entscheidend für die betriebliche Effizienz und das Kostenmanagement. Ein wichtiger Aspekt ist die Abschreibungsrate von Maschinen, insbesondere von Bestückungsautomaten. Diese Maschinen spielen eine wichtige Rolle in verschiedenen Branchen, von der Elektronik bis zur Automobilherstellung. In diesem Artikel erfahren Sie, was Bestückungsautomaten sind, wie sie sich abschreiben und welche Faktoren ihre Abschreibungsraten beeinflussen.

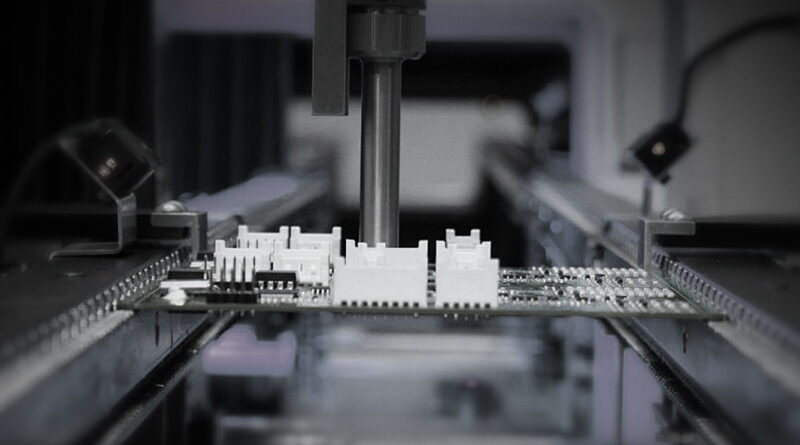

Was sind Pick-and-Place-Maschinen?

Bestückungsautomaten sind automatisierte Geräte zur Entnahme und Bestückung von Bauteilen auf Leiterplatten (PCBs) oder anderen Substraten. Sie sind in Fertigungsstraßen unverzichtbar, insbesondere in der Elektronikbranche, wo Geschwindigkeit und Präzision von größter Bedeutung sind. Diese Maschinen verbessern die Effizienz, indem sie die manuelle Arbeit reduzieren und die Produktionsraten erhöhen, aber sie stellen auch eine erhebliche Investition dar.

Die Grundlagen der Abschreibung

Die Abschreibung ist eine Buchhaltungsmethode, mit der die Kosten einer Sachanlage über ihre Nutzungsdauer verteilt werden. Sie hilft Unternehmen, den aktuellen Wert ihrer Vermögenswerte zu ermitteln, und bietet Steuervorteile auf der Grundlage eines Kostenausgleichs. Einfacher ausgedrückt: Wenn Maschinen und Anlagen im Laufe der Zeit genutzt werden, sinkt ihr Wert, und dieser Rückgang wird als Aufwand verbucht. Für Hersteller, die ihre Finanzstrategien optimieren wollen, ist es wichtig zu verstehen, wie die Abschreibung funktioniert.

Gängige Abschreibungsmethoden

Für die Berechnung der Abschreibung gibt es verschiedene Methoden. Zu den gängigsten Methoden gehören:

- Lineare Abschreibung: Bei dieser Methode werden die Kosten des Vermögenswerts gleichmäßig über seine Nutzungsdauer verteilt. Sie ist einfach und wird in der Regel für Maschinen mit einer vorhersehbaren Lebensdauer verwendet.

- Degressive Methode: Dabei handelt es sich um eine beschleunigte Abschreibungsmethode, bei der der Wert des Wirtschaftsguts in den ersten Jahren seiner Lebensdauer schneller abnimmt. Sie eignet sich für Maschinen, die einen schnellen technologischen Fortschritt erfahren.

- Produktionseinheiten Methode: Diese Methode basiert auf der tatsächlichen Nutzung des Geräts. Sie ist besonders nützlich in der Fertigung, wo die Leistung erheblich schwanken kann.

Faktoren, die die Abschreibungsrate von Pick-and-Place-Maschinen beeinflussen

Um die Abschreibungsrate von Bestückungsautomaten zu verstehen, müssen mehrere Faktoren berücksichtigt werden:

1. Anfängliche Kosten

Je höher die Anschaffungskosten des Bestückungsautomaten sind, desto größer sind die Auswirkungen der Abschreibung. Hochwertige Maschinen sind oft mit einer größeren Investition verbunden, und die Kenntnis ihrer Abschreibung kann Investitionsentscheidungen beeinflussen.

2. Nutzungsdauer

Jedes Gerät hat eine bestimmte Nutzungsdauer, die sich auf den Abschreibungsplan auswirken kann. Die geschätzte Lebensdauer von Bestückungsautomaten kann je nach Modell und Einsatzbedingungen zwischen 5 und 15 Jahren liegen.

3. Technologischer Fortschritt

Angesichts des raschen technischen Fortschritts verlieren ältere Bestückungsautomaten schneller an Wert. Neue Modelle zeichnen sich oft durch eine höhere Geschwindigkeit, Effizienz und Leistungsfähigkeit aus, was ältere Modelle weniger begehrenswert machen kann.

4. Verwendungsmuster

Die Häufigkeit und Intensität der Nutzung einer Maschine wirkt sich direkt auf ihre Abnutzung aus und beeinflusst ihre Gesamtlebensdauer und Abschreibungsrate. Maschinen, die unter hohen Belastungen arbeiten, können eine kürzere Nutzungsdauer haben.

5. Wartung und Upgrades

Regelmäßige Wartung und rechtzeitige Aufrüstung können dazu beitragen, die Lebensdauer einer Maschine zu verlängern und damit ihren Wertverlust zu beeinflussen. Gut gewartete Maschinen können sich langsamer abnutzen als solche, die vernachlässigt werden.

Berechnung der Abschreibung von Bestückungsautomaten

Betrachten wir ein hypothetisches Beispiel, um die Berechnung der Abschreibung nach der linearen Methode zu veranschaulichen:

Stellen Sie sich vor, Sie kaufen eine Bestückungsmaschine zum Preis von $100.000, mit einer geschätzten Nutzungsdauer von 10 Jahren und einem Restwert von $10.000. Die jährliche Abschreibung würde wie folgt berechnet werden:

Jährliche Abschreibung = (Kosten - Restwert) / Nutzungsdauer Jährliche Abschreibung = ($100.000 - $10.000) / 10 = $9.000.

Das bedeutet, dass jedes Jahr $9.000 als Abschreibung im Jahresabschluss verbucht wird, wodurch sich der Buchwert der Maschine schrittweise verringert.

Auswirkungen auf die Finanzberichterstattung

Eine genaue Abschreibungsbuchhaltung ist für die Finanzberichterstattung unerlässlich. Sie wirkt sich auf das steuerpflichtige Einkommen des Unternehmens, die Unternehmensbewertung und die finanzielle Gesundheit von Fertigungsunternehmen aus. Investoren und Stakeholder achten genau darauf, wie gut ein Unternehmen seine Vermögenswerte verwaltet. Dazu gehört auch das Verständnis der Abschreibungssätze für kritische Maschinen, wie z. B. Bestückungsautomaten.

Die Auswirkungen der Abschreibung auf Unternehmensentscheidungen

Die ordnungsgemäße Verbuchung von Abschreibungen hilft den Entscheidungsträgern eines Unternehmens in vielerlei Hinsicht:

- Budgetierung und Vorhersage: Die Kenntnis der Abschreibungsraten hilft bei der genauen Budgetierung für künftige Anschaffungen und Ersatzbeschaffungen von Geräten.

- Investitionsentscheidungen: Wenn man weiß, wie schnell sich eine Maschine abnutzt, kann man Entscheidungen über die Aufrüstung oder den Ersatz von Maschinen treffen.

- Bewertung der finanziellen Gesundheit: Um die Rentabilität und Nachhaltigkeit eines Unternehmens zu beurteilen, ziehen Investoren häufig in Betracht, wie effektiv es seine Abschreibungen verwaltet.

Schlussfolgerung

Das Verständnis der Abschreibungsraten von Bestückungsautomaten ist für Hersteller, die ihren Betrieb und ihre Finanzberichterstattung optimieren wollen, von entscheidender Bedeutung. Durch die Berücksichtigung der verschiedenen Faktoren, die die Abschreibung beeinflussen, und die Anwendung geeigneter Berechnungsmethoden können Unternehmen sachkundige Entscheidungen treffen, die letztlich zu einer Verbesserung ihres Endergebnisses führen.