Peisajul global de producție este în continuă evoluție și, odată cu el, și utilajele utilizate în procesele de producție. Pentru întreprinderile implicate în fabricarea și asamblarea produselor electronice, mașinile de preluare și plasare sunt vitale pentru automatizarea asamblării componentelor pe plăcile cu circuite imprimate (PCB). Cu toate acestea, odată cu complexitatea crescândă a comerțului internațional, înțelegerea tarifelor de import asociate acestor mașini poate reprezenta o provocare. Această postare pe blog își propune să ofere o prezentare detaliată a Tarife de import pentru mașinile pick-and-place, factorii care le influențează și strategiile pe care întreprinderile le pot adopta pentru a naviga prin aceste complexități.

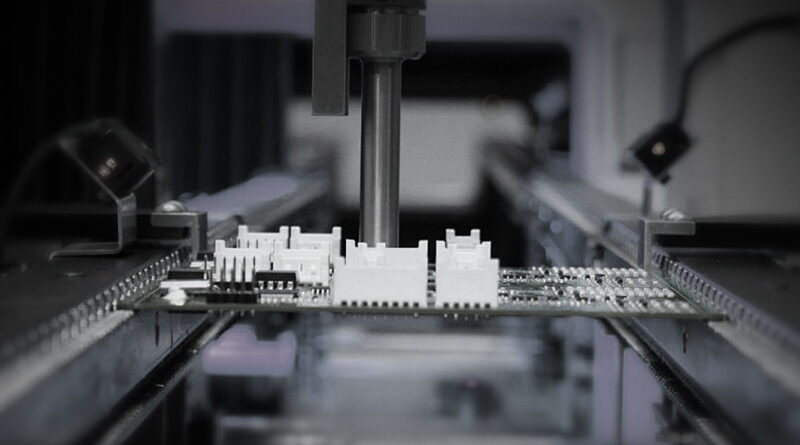

Înțelegerea mașinilor Pick-and-Place

Mașinile pick-and-place sunt dispozitive automate care pot muta rapid și precis componente dintr-o locație în alta. Utilizate în principal în industria electronică, aceste mașini sporesc productivitatea, minimizând în același timp eroarea umană. Înțelegerea funcționalității acestor mașini este esențială nu numai pentru eficiența operațională, ci și pentru gestionarea costurilor legate de importul acestora.

Creșterea comerțului mondial și impactul tarifelor

În ultimii ani, piața mondială a utilajelor de producție s-a extins, ducând la o creștere a fluxului transfrontalier de mărfuri. Cu toate acestea, această expansiune nu a fost lipsită de provocări. Concurența intensă, reglementările guvernamentale și factorii geopolitici au condus la tarife de import stricte în diferite regiuni. Tarifele de import pot avea un impact semnificativ asupra costului total al introducerii mașinilor pick-and-place într-o țară sau regiune.

Ce sunt tarifele de import?

Tarifele de import sunt taxe impuse de guverne asupra bunurilor importate din alte țări. Aceste tarife pot servi mai multor scopuri, inclusiv protejarea industriilor naționale de concurența străină, generarea de venituri pentru guvern și ca instrument de politică externă. Pentru producătorii care doresc să importe mașini pick-and-place, aceste tarife pot adăuga o cheltuială considerabilă la costul total al echipamentului.

Factorii care influențează tarifele de import pentru mașinile Pick-and-Place

Mai mulți factori contribuie la determinarea tarifelor de import pentru mașinile pick-and-place:

- Țara de origine: Ratele tarifare pot varia în funcție de țara din care este importat utilajul. Țările care au încheiat acorduri de liber schimb cu țara importatoare beneficiază adesea de rate tarifare mai mici.

- Specificațiile mașinii: Particularitățile mașinii, cum ar fi capacitatea, nivelul de automatizare și tehnologia, pot influența clasificarea sa tarifară.

- Relații comerciale: Relațiile diplomatice și comerciale generale dintre țările exportatoare și importatoare pot afecta ratele tarifare. De exemplu, tensiunile comerciale pot duce la creșterea tarifelor.

- Politici guvernamentale: Cotele de import, controlul exporturilor și stimulentele pentru producția locală pot, de asemenea, modela structurile tarifare. Guvernele pot crește tarifele pentru a promova industria locală sau le pot reduce pentru a încuraja transferul de tehnologie.

Cum să cercetați tarifele mașinilor Pick-and-Place

Înțelegerea tarifelor aplicabile este esențială pentru bugetarea și planificarea eficientă. Iată pașii de cercetare a tarifelor de import pentru mașinile pick-and-place:

- Consultați site-urile guvernamentale: Majoritatea guvernelor publică listele tarifare actualizate pe site-urile lor oficiale. Deseori, țările au departamente vamale sau comerciale specializate care oferă informații valoroase.

- Utilizați codurile HTS: Codurile HTS (Harmonized Tariff Schedule) pot fi utile în determinarea taxelor de import specifice. Puteți găsi codul HTS aplicabil pentru mașinile pick-and-place și consulta ratele taxelor vamale corespunzătoare.

- Colaborați cu experți în comerț: Consultarea brokerilor vamali sau a experților în comerț poate oferi informații personalizate și poate ajuta la parcurgerea eficientă a proceselor complexe de import.

- Participați la târguri: Participarea la târguri și conferințe sectoriale poate ajuta la crearea de rețele cu alte întreprinderi și la obținerea de informații de primă mână privind tarifele și practicile comerciale.

Strategii pentru minimizarea tarifelor de import

Deși tarifele de import sunt adesea inevitabile, există diverse strategii pe care întreprinderile le pot utiliza pentru a atenua impactul lor financiar:

- Utilizați acordurile de liber schimb: Utilizarea acordurilor de liber schimb existente poate reduce semnificativ sau chiar elimina tarifele. Întreprinderile ar trebui să fie proactive în înțelegerea ALS aplicabile tranzacțiilor lor.

- Luați în considerare clasificarea tarifară: Clasificarea corectă a mărfurilor poate duce la rate tarifare diferite. Determinând cu exactitate clasificarea tarifară corectă pentru mașinile pick-and-place, întreprinderile pot beneficia potențial de tarife mai mici.

- Negociați cu furnizorii: Adesea, furnizorii pot avea informații sau opțiuni privind strategiile de stabilire a prețurilor care țin seama de tarife, cum ar fi plata în avans a tarifelor sau luarea în considerare a piețelor alternative de aprovizionare.

- Asamblare locală sau integrare a producției: Crearea unei linii de asamblare locale poate reduce uneori tarifele. În anumite jurisdicții, tarifele se aplică mașinilor complet asamblate, dar pot fi reduse pentru componente.

Viitorul tarifelor de import în sectorul producției de produse electronice

Pe măsură ce tehnologia avansează și politicile comerciale globale evoluează, situația tarifelor de import pentru utilaje, inclusiv pentru mașinile pick-and-place, va continua să se schimbe. Tendințele emergente în producția globală, cum ar fi relocalizarea și promovarea practicilor durabile, pot influența, de asemenea, strategiile tarifare. Întreprinderile trebuie să rămână adaptabile și informate pentru a răspunde eficient la aceste schimbări.

Gânduri finale

Înțelegerea și navigarea tarifelor de import pentru mașinile pick-and-place este esențială pentru succesul producătorilor de electronice. Cu abordarea și resursele adecvate, întreprinderile pot gestiona eficient costurile și pot menține avantaje competitive pe o piață internațională dinamică. Cunoașterea înseamnă putere în domeniul comerțului; dotați-vă cu informațiile corecte și navigați în complexitatea tarifelor de import cu încredere.