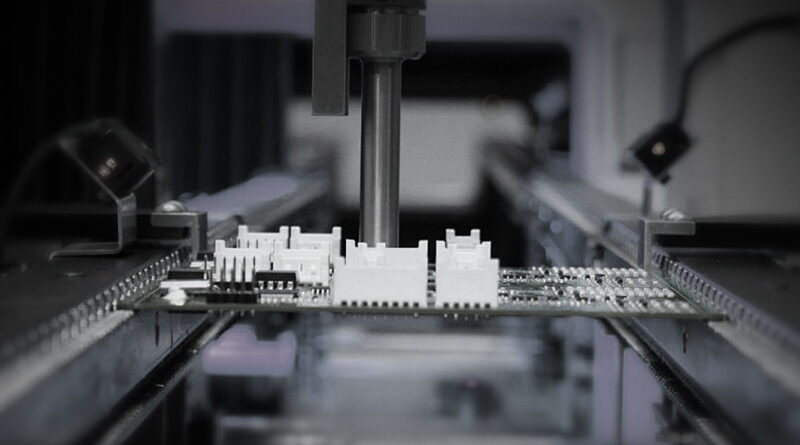

Les machines de placement SMT, également appelées "machines de placement" ou "systèmes de montage en surface", sont des équipements essentiels dans les lignes de production de la technologie de montage en surface. La technologie SMT est actuellement une technologie et un processus populaires dans l'industrie de l'assemblage électronique. Selon un rapport publié par un institut d'études de marché bien connu, le marché mondial des équipements d'assemblage SMT devrait croître de $600 millions de dollars US entre 2021 et 2025, avec un taux de croissance annuel composé de 6% d'ici 2024. Sur la base d'une analyse de chaque région et de sa contribution au marché mondial, les données estiment que la Chine, les États-Unis, l'Allemagne, le Japon et le Royaume-Uni resteront les principaux marchés de l'équipement d'assemblage SMT. D'ici 2024, les marchés de niche tels que l'électronique grand public, l'automobile et les communications devraient devenir l'un des principaux moteurs du marché, avec des implications significatives pour les utilisateurs finaux. Dans ce chapitre, nous souhaitons donner un aperçu de la progression du développement des machines SMT pick and place, non seulement sur le marché chinois, mais aussi sur le marché mondial.

Tout d'abord, nous souhaitons présenter l'analyse du développement de l'industrie chinoise des machines de placement SMT. Les machines de montage en surface ont un large éventail d'applications, un contenu technique élevé et peuvent stimuler le développement d'industries de base connexes telles que la fabrication de machines de précision, la détection de haute précision, la fabrication de moteurs à haute performance, le traitement de l'image et les logiciels. Depuis le début des années 1990, les entreprises et les institutions nationales s'efforcent continuellement de localiser les entreprises de montage en surface. Avec l'amélioration des technologies de production, les fabricants chinois d'équipements de montage en surface professionnels émergent rapidement. En 2020, la Chine a importé 18 000 machines automatiques de placement SMT, ce qui représente une augmentation de 34% en glissement annuel ; la Chine a exporté 17 000 machines automatiques de placement SMT, ce qui représente une diminution de 87% en glissement annuel.

Du point de vue de la répartition régionale, la région du delta de la rivière des Perles continue de dominer, représentant plus de 62% du marché, suivie par la région du delta de la rivière Yangtze, qui représente environ 21%, puis par diverses entreprises électroniques et institutions de recherche dans d'autres provinces de Chine, qui représentent environ 20% de la demande du marché. Au cours des années précédentes, les produits nationaux de machines de placement SMT étaient principalement des machines de placement de LED de faible technologie. Comme les entreprises chinoises développent de plus en plus de machines de placement SMT à grande vitesse et à haute précision, les domaines d'application des machines de placement SMT produites en Chine s'étendent et les volumes de production continuent d'augmenter. En 2021, le volume de production de machines de pose de CMS en Chine était d'environ 44 781 unités, tandis que la demande de machines de pose de CMS était de 49 568 unités. La qualité des machines de placement produites dans le pays ne cesse de s'améliorer et elles offrent un avantage de prix par rapport aux produits importés. Combiné à la croissance soutenue de la demande d'exportation, on s'attend à ce que le volume de production de machines de placement en Chine continue d'augmenter à l'avenir. Notre entreprise, Nectec, en est un excellent exemple. Elle a développé de manière indépendante des machines de placement SMT de haute précision et à grande vitesse. On prévoit que d'ici 2027, la production de machines de placement SMT en Chine dépassera les 100 000 unités. Les entreprises en aval de l'industrie de fabrication d'équipements électroniques industriels SMT comprennent principalement des fabricants d'écrans de télévision couleur, de téléphones portables et d'ordinateurs. Comme les industries en aval continuent à se développer rapidement, la demande d'équipements de fabrication de CMS, y compris les machines de placement, augmentera également rapidement. On prévoit que d'ici 2027, la demande chinoise de machines de placement SMT atteindra 114 000 unités.

Deuxièmement, laissez‘passons maintenant à la discussion sur les tendances technologiques futures dans l'industrie de l'équipement SMT. La nouvelle révolution technologique et la pression sur les coûts ont donné naissance à une fabrication automatisée, intelligente et flexible, ainsi qu'à des systèmes intégrés pour l'assemblage, la logistique, l'emballage et les essais (MES). Les équipements SMT ont amélioré les niveaux d'automatisation dans l'industrie électronique grâce aux avancées technologiques, ce qui a permis de réduire les besoins en main-d'œuvre, de diminuer les coûts de main-d'œuvre, d'augmenter la production individuelle et de maintenir la compétitivité. Nous résumons ici plusieurs caractéristiques essentielles au développement de cette industrie. Il s'agit avant tout d'une grande précision et d'une grande flexibilité : la concurrence industrielle s'intensifie, les cycles de lancement de nouveaux produits sont de plus en plus courts et les exigences environnementales sont de plus en plus strictes. Nous devons nous aligner sur les tendances à la réduction des coûts et à la miniaturisation, qui imposent des exigences plus élevées aux équipements de fabrication électronique. Les appareils électroniques évoluent vers une plus grande précision, des vitesses plus élevées, une plus grande facilité d'utilisation, un meilleur respect de l'environnement et une plus grande flexibilité. Nous pouvons également permettre à la tête de prélèvement et de placement de passer automatiquement d'une fonction à l'autre, ce qui lui permet d'effectuer la distribution, l'impression et la détection du retour d'information. Cela renforcera la stabilité de la précision du placement et améliorera considérablement la compatibilité et la flexibilité entre les composants et les substrats ; Le deuxième point concerne la vitesse et la miniaturisation : Le développement progressif du SMT a apporté les avantages d'une grande efficacité, d'une faible consommation d'énergie, d'un encombrement minimal et de faibles coûts. À l'avenir, il y aura une demande croissante de machines de prélèvement et de placement à grande vitesse et multifonctionnelles qui offrent à la fois une grande efficacité et une multifonctionnalité. Les modèles de production dotés de plusieurs pistes et postes de travail peuvent atteindre un taux de production d'environ 100 000 CPH.

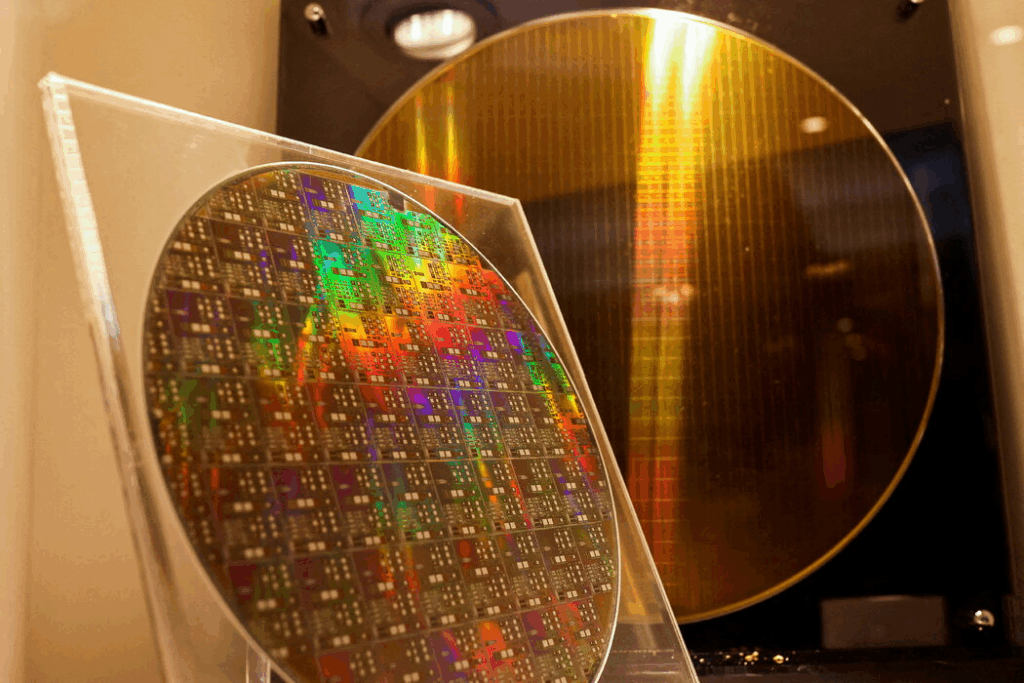

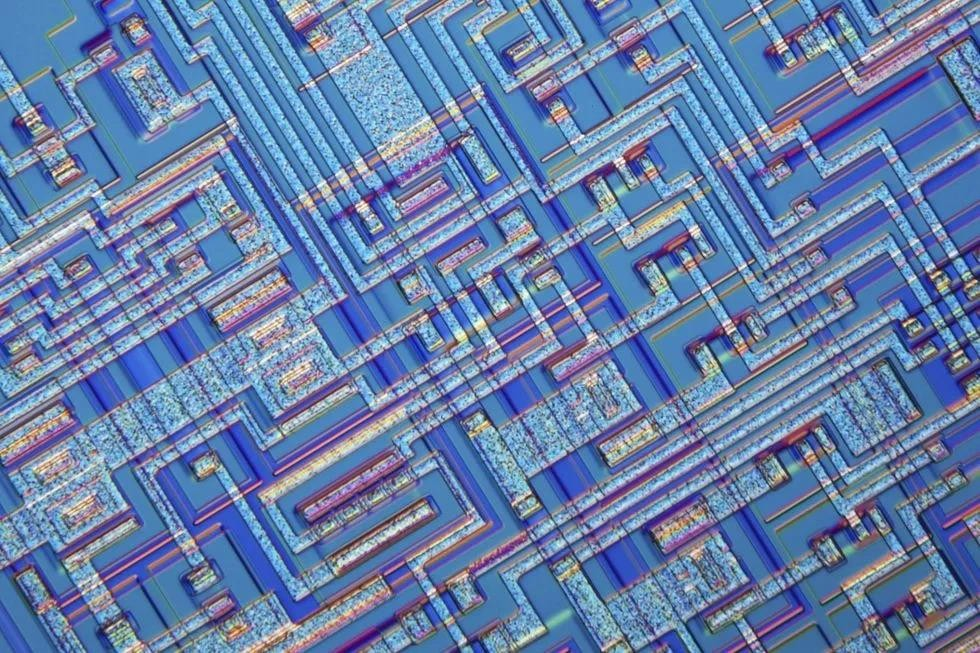

Actuellement, la machine haut de gamme NT-LS9 Dual Nozzle Holder Linear Motor Ultra-High-Speed Wireless SMT de Nectec peut atteindre une vitesse de placement théorique maximale de 500 000 CPH, dépassant de loin cette attente. Le troisième point est la tendance à l'intégration de l'emballage des semi-conducteurs et de la technologie SMT : les produits électroniques étant de plus en plus petits, de plus en plus diversifiés en termes de fonctionnalités et de plus en plus précis dans la conception des composants, l'intégration de l'emballage des semi-conducteurs et de la technologie de montage en surface est devenue une tendance inéluctable. Les fabricants de semi-conducteurs ont commencé à adopter la technologie de montage en surface à grande vitesse, tandis que les lignes de production de montage en surface ont également intégré certaines applications de semi-conducteurs, brouillant ainsi les frontières traditionnelles entre les domaines technologiques. Cette convergence des technologies a également conduit au développement de nombreux produits qui ont été bien accueillis par le marché. La technologie des procédés POP et la technologie des procédés sandwich sont désormais largement utilisées dans les produits intelligents haut de gamme.

En conclusion, la tendance à l'intégration de l'emballage des semi-conducteurs et de la technologie de montage en surface est motivée par la demande de performances accrues, de miniaturisation et de rentabilité dans le domaine de la fabrication électronique. Les technologies d'emballage avancées, telles que l'emballage en éventail au niveau de la plaquette et le système dans l'emballage, fusionnent avec les processus SMT pour permettre la fabrication d'appareils plus petits, plus rapides et plus fiables. Cette intégration réduit les longueurs d'interconnexion, améliore les performances thermiques et électriques et rationalise la production, ce qui la rend essentielle pour les applications de la 5G, de l'IoT et de l'IA. Par conséquent, la combinaison de l'emballage des semi-conducteurs avec le SMT améliore l'évolutivité et répond au besoin croissant de systèmes électroniques compacts et à haute fonctionnalité.